B90 Holdings (formerly Veltyco Group) announced on 7 May 2020 that it had set up new financing to ward off insolvency. The company, founded by German Uwe Lenhoff, the suspected head of a cybercrime organization, and listed on the London Stock Exchange, has issued convertible loan notes for the third time in the last 8 months and received GBP 450,000. The money was urgently used to pay critical creditors and regulatory charges and fees. Trading in the company’s shares on the London Stock Exchange has been suspended since mid-March 2020 already.

The notes have been subscribed again by the Dutch investor Peter Paul Westerterp and another undisclosed investor. Additionally, the company’s director Mark Rosman has subscribed. Westerterp and Rosman are currently holding approximately 4.4% and 3.1% respectively of B90 Holdings’ issued share capital. The fresh money is too little to live and too much to die. I think it’s only to keep the company from dying these days. It’s zombie financing.

The Dutch shareholders around Dirk Jan “DJ” Bakker and the CFO Marcel Noordeloos keep the company alive since the arrest of Lenhoff in January 2019. The COVID-19 crisis has further exacerbated the tense financial situation. The current core business of sports betting is not functioning due to sports events not taking place.

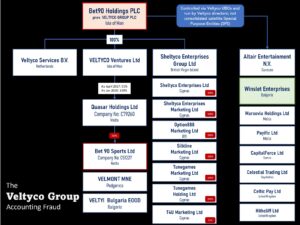

B90 Holdings is at the center of criminal investigations in several jurisdictions within and outside the EU. Lenhoff, with the support of its director Marcel Noordeloos, has used B90 Holdings to conduct illegal business through subsidiaries in the Balkans and Bulgarian as well as through offshore vehicles. Lenhoff and more than a dozen suspects are awaiting indictment on charges of operating a criminal organization, investment fraud, and money-laundering.