Since the crypto craze of 2017, digital currencies like Bitcoin have become a recognized alternative asset class. Despite ongoing regulatory skepticism and market manipulation concerns from bodies like the U.S. SEC, the crypto market continues to thrive. Bitcoin is no longer a novelty—it’s been around for over a decade—and now, many market watchers believe another massive bull run is on the horizon, with forecasts reaching up to $300,000 within 12 months.

A Scarce Digital Asset With Built-In Monetary Discipline

Bitcoin’s appeal among economists and investors lies in its predictable, finite supply. Capped at 21 million coins, Bitcoin mimics the scarcity of gold rather than the inflationary nature of fiat currencies. This hard-coded limit fuels the argument that BTC functions as “sound money” outside the control of governments.

One of the most anticipated supply-related events is the Bitcoin “halving,” which reduces mining rewards and slows the rate of new BTC entering circulation. Around May 12, 2020, the reward dropped from 12.5 to 6.25 BTC per block, slashing annual supply growth from 3.72% to 1.79%. For the first time, Bitcoin’s issuance rate dipped below the 2% inflation benchmark that many central banks use as a target.

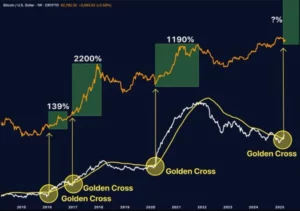

Historical Halvings and Bull Runs

This isn’t Bitcoin’s first halving—it’s the third. Historical data suggests each of the previous events triggered extended price rallies lasting 18 to 24 months. After the first halving in 2012, BTC surged to around $1,100 before dropping to $213. Following the 2016 halving, the price exploded to nearly $20,000 before falling back to around $3,600 in late 2018. By May 2020, BTC had already recovered to $9,000. If this pattern holds, some experts argue we could see prices exceeding $300,000 in the current cycle.

Reports from research groups like Kraken Intelligence support the idea that halvings drive long-term bullish trends, with demand outpacing the diminishing supply.

Digital Gold or Practical Payment System?

While Bitcoin is increasingly accepted as a long-term investment, it remains inefficient as a daily payment method. Its network is not optimized for high-speed transactions, and transfers can take hours to process. In contrast, platforms like TransferWise, Revolut, Monzo, and N26 offer faster, more practical solutions for everyday financial needs.

However, when viewed as a store of value, Bitcoin shines. Often referred to as “digital gold,” it has carved out a role for itself as a hedge against monetary expansion and inflation. Whether the $300,000 target becomes reality remains uncertain—but for many in the crypto space, the data-driven optimism is reason enough to prepare for a potentially historic bull run.