The European Funds Recovery Initiative (EFRI), co-established by FinTelegram, has announced its intention to report financial service providers tied to fraudulent activities to the appropriate regulatory bodies. According to EFRI, many fintech startups are increasingly acting as payment service providers (PSPs) for scam operations, often without enforcing proper Know-Your-Customer (KYC) and Anti-Money Laundering (AML) protocols.

While EFRI does not claim the authority to determine whether these PSPs have violated laws or financial regulations, it strongly believes in the need for audits—especially when investor protection is at stake. Regulatory bodies often overlook the involvement of these companies in fraudulent networks, which is why EFRI is stepping in to support oversight efforts on behalf of defrauded retail investors.

Positioning itself as a cross-border advocacy group, EFRI acts like a financial ombudsman, aiming to protect retail investors and promote accountability in the financial sector. The organization intends to present its research and evidence to regulators, pushing for thorough investigations and legal redress where applicable. As EFRI principal Elfriede Sixt emphasized, the goal is to ensure retail investors are not left behind or ignored.

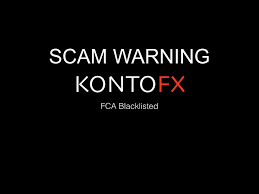

One particular case under review involves International Fintech UAB, a Lithuania-based company regulated by the Bank of Lithuania. This firm allegedly operated as a PSP in connection with the large-scale broker scam KontoFX (as detailed in a FinTelegram report). EFRI has formally requested the Bank of Lithuania to conduct a compliance audit into International Fintech UAB, citing the significant financial harm experienced by investors.

Enhanced scrutiny of PSPs engaged in high-risk operations is crucial for safeguarding the integrity of the EU’s financial system—and EFRI asserts this kind of oversight is non-negotiable.