Over the past five years, Lithuania and Estonia emerged as hotspots for FinTech startups and, unfortunately, also for operators linked to scams and high-risk clients. Insiders long noted that both countries — members of the European Union — had adopted a lenient stance when it came to issuing financial licenses. This open-door policy led many crypto-related businesses to formally register in Estonia, often taking advantage of superficial regulatory oversight.

Meanwhile, Lithuania attracted a wave of e-money institutions (EMIs) and payment processors. FinTelegram has frequently reported on how a subset of these companies enabled scams and facilitated money laundering through their services. For a long time, regulatory authorities in the region appeared indifferent — but that complacency seems to be over.

Bruc Bond Revocation Signals a Shift

On April 22, 2020, the Bank of Lithuania (LB) made a decisive move by revoking the license of Bruc Bond UAB (formerly Moneta International UAB). Operating under the brand “Brüc Bond,” the company’s license termination marks a significant regulatory development and appears to signal a tougher stance on oversight. The public nature of the LB’s announcement suggests that financial authorities are no longer tolerating questionable FinTech activity.

According to the regulator, Bruc Bond was expected to publicly disclose the license revocation — yet as of April 23, 2020, no such announcement had been made on the company’s official website (www.brucbond.com).

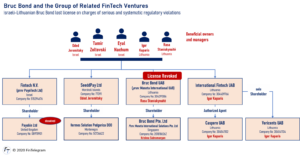

Bruc Bond is owned by Israeli nationals Eyal Nachum and Tamir Zoltovski, who present themselves as experienced figures in the FinTech space. Beyond Bruc Bond, they reportedly operate a network of both licensed and unlicensed payment platforms, including Payobin (Payotech Ltd) and International Fintech UAB, another licensed entity in Lithuania.

FinTelegram has previously identified Bruc Bond as one of several financial service providers that profited from servicing fraudulent schemes. The revocation of its license may be the start of a broader regulatory crackdown — a long-awaited effort to purge the FinTech landscape of operators who enable or profit from illicit activity.