The U.S. investigation into the OneCoin crypto fraud is unfolding like a modern-day Shakespearean saga, centered around Ruja Ignatova, the self-styled “Cryptoqueen.” Accusations of betrayal, financial crime, and international intrigue are surfacing, painting a global picture involving players across Europe, North America, Russia, and several offshore jurisdictions. According to reports, Ignatova is believed to be hiding in Russia, which could spark geopolitical tensions as legal pressure intensifies.

Konstantin Ignatov’s Deal with U.S. Authorities

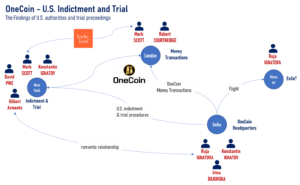

Konstantin Ignatov, the 33-year-old brother of Ruja Ignatova, agreed to cooperate with U.S. prosecutors in exchange for a lighter sentence and potential entry into the Witness Protection Program. Though he was not a high-level executive at OneCoin, he played a supporting role to his sister. Before joining the scheme, he reportedly worked in a dog kennel and is heavily tattooed — a stark contrast to the high-stakes crypto empire he would later be part of.

As part of his cooperation, Ignatov provided testimony in the case against former U.S. attorney Mark S. Scott, who is accused of laundering vast sums tied to OneCoin.

Law Firm Involvement – Locke Lord, Mark Scott, and Robert Courtneidge

According to court records, Scott and his former colleague at Locke Lord LLP, Robert Courtneidge, were involved in facilitating OneCoin’s financial operations. Prosecutors claim that Scott laundered roughly $400 million on behalf of Ruja Ignatova through a complex network of shell companies and offshore accounts. Scott has implicated Courtneidge as a collaborator, alleging that the money laundering occurred largely through Locke Lord’s London office, where cash transactions were also allegedly handled.

From Locke Lord to Moorwand and KBH Andelskasse

After leaving Locke Lord in early 2018, Courtneidge became CEO of UK-based Moorwand Ltd, a payment service provider allegedly connected to several broker scams. FinTelegram reported that Moorwand helped route illicit funds through the now-defunct Danish bank KBH Andelskasse, which collapsed in 2018 and is currently under investigation by Danish authorities. Courtneidge, along with entities like UPC Consulting, is said to be a person of interest in those proceedings. Whether Moorwand or KBH Andelskasse played a direct role in OneCoin’s operations remains an open question.

David R. Pike – The Fund Manager Under Fire

David R. Pike, a close associate of Mark Scott, was also arrested in connection with the case. Pike served as COO of a private equity management firm overseeing the Fenero Funds — the same funds used to launder money for OneCoin, according to U.S. authorities.

Prosecutors allege Pike made knowingly false statements to federal investigators, denying knowledge of the illicit origins of roughly $400 million linked to OneCoin and Ruja Ignatova. These funds were allegedly funneled through institutions including the Bank of Ireland, from the Cayman Islands and BVI, and later redirected to the UAE. Pike faces charges under U.S. Code Title 18, Section 1001, for providing false information.

The Enigmatic Gilbert Armanta – Lover, Partner, Informant?

A mysterious figure named Gilbert Armanta has also emerged in the trial. Allegedly a U.S. citizen and close associate of both Scott and Ignatova, Armanta is reported to have had a romantic relationship with the Cryptoqueen. According to her brother, Armanta ultimately betrayed Ignatova, tipping off the FBI. In retaliation, Ignatova is believed to have secretly recorded a conversation with him, which has since surfaced online.

Armanta is suspected of playing a central role in the laundering process alongside Scott, but his full involvement remains unclear. Much like Courtneidge, additional evidence is needed to complete the picture.