Operating a global financial intelligence service comes with a unique advantage: access to a vast amount of information from various people about different companies and ventures. Occasionally, this comes with threats from individuals unhappy with certain reports. Some have accused FinTelegram’s team of using the site as a form of “revenge” and have resorted to blackmail, targeting team members and their families. However, we view this as business, not personal.

FinTelegram has been covering VELTYCO since its early days in March 2018. Previously, this company was heavily involved in binary options. However, binary options are regarded as illegal and therefore banned in many jurisdictions (see our report here). As a result, VELTYCO sought new opportunities and turned to cryptocurrencies and crypto-trading. Upon VELTYCO’s announcement of this pivot, the company’s shares surged nearly 20%. Quite thrilling, right? It was “Bitcoin Boom Time” in December 2018, and VELTYCO understandably seized the moment.

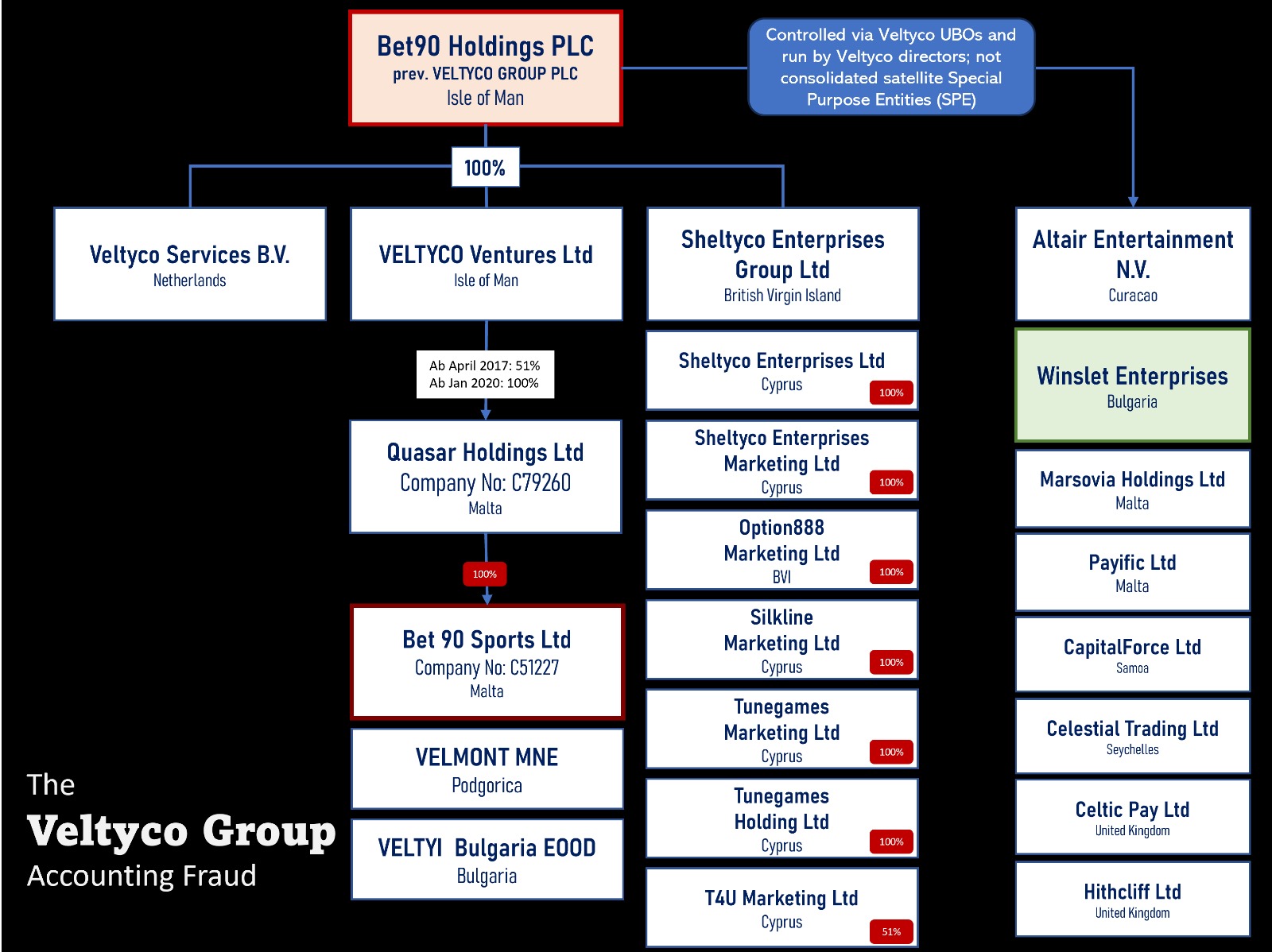

Veltyco Moves to Bulgaria (Again)

Following this shift, on January 17, 2018, VELTYCO acquired a 51% stake in a Bulgarian company called VARKASSO LTD, securing access to a crypto-wallet software known as 8Crypt. As stated:

Varkasso and Veltyco with Uwe Lenhoff and Joachim Kalcher

Varkasso Ltd held by VELTYCO and BlackCyan

Veltyco Group plc (AIM

), an online marketing company within the gaming industry, is pleased to announce that, further to its 21 December 2017 announcement, it has reached an agreement to acquire a 51% stake in Varkasso Limited (“Varkasso”). Varkasso exclusively holds the rights to use 8Crypt, a blockchain-based crypto wallet platform. 8Crypt, developed by Varkasso’s founder and shareholder, enables users to manage, trade, and accept both traditional and crypto currencies from a single platform. (Source: VELTYCO Press Release)

Interestingly, VELTYCO didn’t disclose much regarding the owners of Bulgarian VARKASSO, likely for specific reasons. In its audited financial statements as of December 31, 2017, VELTYCO reported this transaction in its subsequent events section. Additionally, the report indicated that the auditor noted an issue in properly identifying related party transactions, a problem that may extend beyond what the auditor observed. Initial investigations into the background of the companies involved revealed some previously undisclosed related party transactions connected to VARKASSO’s 51% share acquisition.

The Bulgarian database Bivol (an official WikiLeaks partner for Bulgaria and the Balkans and part of the Organized Crime and Corruption Reporting Project) indicates that VARKASSO (Company ID 204747934) was founded by Uwe LENHOFF on September 1, 2017. On February 7, 2018, LENHOFF then transferred the shares to a company called BLACKCYAN LTD (Company ID: 204904823), another Bulgarian entity established by Austrian Joachim KALCHER. KALCHER was subsequently appointed as VARKASSO’s CEO. This transaction was registered long after VELTYCO announced its acquisition of 51% of VARKASSO. In March 2018, BLACKCYAN sold 51% of VARKASSO to VELTYCO (per the Bulgarian commercial register).

It appears VELTYCO acquired the shares indirectly from LENHOFF through BLACKCYAN LTD, for a total of €300,000. At the time of the intended transaction, LENHOFF was still the owner of VARKASSO and was also serving as VELTYCO’s COO and board member—a rather peculiar arrangement. We believe this qualifies as a related party transaction, despite any separate agreement between KALCHER and LENHOFF. The lack of transparency surrounding this transaction invites considerable speculation:

Veltyco has agreed to acquire a 51% interest in Varkasso for a total consideration of €300,000 (approximately £265,000) to be satisfied through the issuance of 100,000 new Ordinary Shares in Veltyco (“Consideration Shares”) and a cash consideration of €200,000 (around £177,000). (Source: VELTYCO Press Release)

Joachim KALCHER

VARKASSO Manager Joachim KALCHER

The Canadian BitRush Connection

Joachim KALCHER, VARKASSO’s manager, is currently involved in legal proceedings regarding “his” software. In November 2017, the Superior Court of Justice in Toronto, Canada, ruled that KALCHER’s software had been developed for the public-listed Canadian BITRUSH CORP, requiring KALCHER to transfer the software in exchange for company shares, which he didn’t fulfill. Back in 2016, VELTYCO (then known as “SHELTYCO”) intended to collaborate with BITRUSH CORP and entered a partnership agreement:

“We in the gaming industry must consider new payment solutions. BitRush, with its ANOON cryptographic payment system and integration with traditional networks like VISA and MasterCard, offers new potential for Sheltyco and the global gaming sector,” stated Uwe Lenhoff, CEO of Sheltyco. (Source: BITRUSH Press Release)

Circumstances changed, however, as the cryptocurrency world gained prominence, leading LENHOFF and KALCHER to pursue a new venture together. Given the legal complexities, it is questionable whether VARKASSO or other companies affiliated with KALCHER (of which there appear to be many) hold the intellectual property rights they claim.

An interesting deal structure, packed with intriguing details. IFRS standards are stringent regarding related party disclosures, as these transactions can significantly impact financial reports and aid in understanding a company’s operations. These disclosures are especially critical for a publicly listed company, yet none of these facts were disclosed by the company.

VARKASSO and its 8Crypt technology are a critical component of other crypto-investment schemes, such as NEXUS GLOBAL. As such, this transaction is more than merely a “VELTYCO” matter and could have lasting implications within the crypto-investment, gaming, and betting sectors.